In week 24, the market will have many fluctuations with hot spots waiting to explode. Investors need to closely follow the following developments to reduce money in a reasonable way.

Binance's Response to the SEC (June 13 - 14)

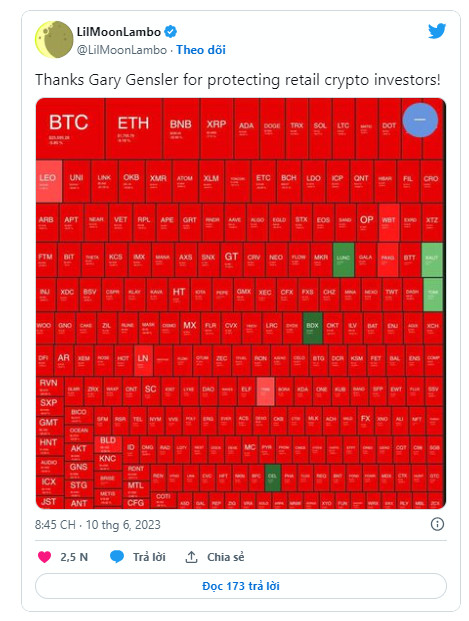

Over the past week, the Securities and Exchange Commission (SEC)'s alleged violations of the Securities and Exchange Act against exchanges has "discolored" the majority of assets in the market. Even the tokens on the "stock list" have lost more than 20-30% of their value at the previous time. More than $85 billion in capitalization has evaporated from the market, Bitcoin is nearing the 25,000 mark, leaving many investors restless when looking at their spot accounts.

The latest development of the case may come on the 12th (US time), because this is the deadline for Binance to respond to the SEC's temporary freeze order filed with the court. After that, the hearing on the case will take place on the 13th. Surely Binance will have to respond to the matter in great detail to counter the SEC complaint, or the court will take action against the court. The largest exchange in the world.

The US District Court will hear the SEC's petition for a temporary injunction against Binance US at 2 p.m. local time (2 a.m. local time). Please pay attention to fasten your seat belt

Philip Swift, Co-Founder of Decentrader

The ban is certainly not what Binance wants, as the exchange has suffered heavy losses even though the incident only started at the beginning of last week. According to DeFiLlama, the outflow of Binance within 7 days (since the SEC alleges) exceeded $3.35 billion – a huge amount for any decentralized exchange. But according to Changpeng Zhao (CZ) - CEO of Binance, high inflow and outflow is normal in the market.

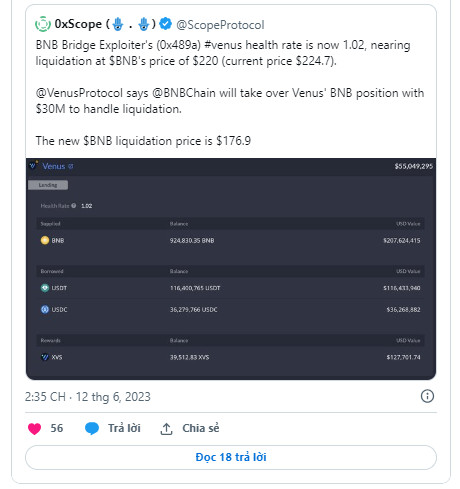

However, if negative developments continue to hit Binance, investors will certainly be very careful when leaving their assets on the exchange or holding related tokens like BNB. Even in peaceful days with no new developments, BNB also suffered a deep drop in price. Currently BNB is fluctuating near the important milestone of 220 - 238 USD, if it goes deeper, about 200 million USD of this asset is at risk of being liquidated on Venus Protocol.

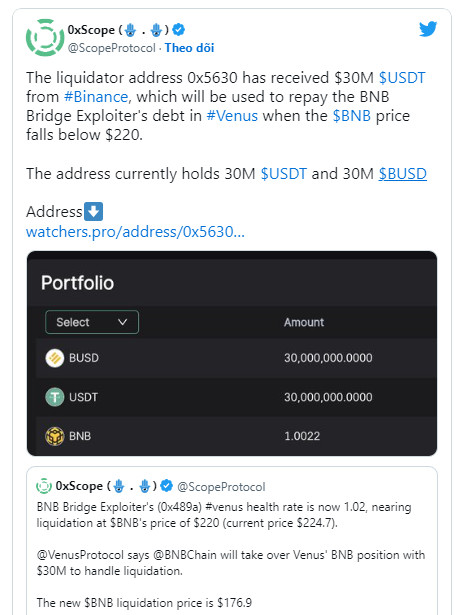

That is supposed to happen in theory, because in fact, Venus Protocol approved the VIP-79 proposal for the BNB Chain team to become the sole liquidator for a position worth more than 200 million USD created by a hacker. established in October 2022. The crypto community was in a panic when it couldn't find the confirmation tweet last year, but Venus Protocol quickly posted the information to correct and update the situation more fully for investors.

According to CoinGecko, 2 million USD of BNB sold on Binance will cause the coin price to drop 2%. If the position on Venus Protocol is liquidated, BNB will surely suffer a deep drop beyond the imagination of investors. According to 0xScope, the liquidity wallet address is holding $60 million in readiness for BNB to drop below $220.

In addition, on June 13, the document of William Hinman - Former SEC Director related to the lawsuit between the SEC and Ripple will be published. Mr. Hinman is the one who claimed Ethereum (ETH) is not a security in a 2018 lawsuit. If the information in the document is favorable for Ripple, this will certainly have a positive effect on Binance and Coinbase. in a confrontation with the SEC over violations of the Securities Act.

US Congressional hearing on crypto (June 14)

The crypto market in the world's largest economy has become increasingly frustrating for many investors, as the SEC - under his leadership Gary Gensler has brought many companies to court. Mr. Gensler has clearly expressed his anti-crypto stance and has always said that apart from Bitcoin, all tokens on this market are securities. Although, while standing on the podium of MIT, Mr. Gensler once asserted that three-quarters of crypto market tokens are not related to securities.

Even Gary Gensler has always assumed that the Securities Law can apply to the crypto market, despite how many people have voiced opposition to this view. However, when the issue came up, like in the case with Coinbase, the SEC denied and showed no cooperation in order to clarify the legal framework for assets that are securities.

This made Coinbase and many investors in the market unhappy. Thereby, turning Gary Gensler and the agency he runs into absurd entities in the eyes of many investors and crypto companies.

During the US Congressional hearing on crypto taking place on June 14, many investors hope to receive regulatory support for this potential market. Especially Brian Armstrong - Coinbase CEO, who stood up to confront the SEC to find regulations specific to the crypto market. Coinbase CEO is determined to stay in the US market because he always hopes and shows his belief in the law here.

The US Congress is also the body that can remove the difficulties for crypto at this time, because exchanges like Binance and Coinbase are entangled in lawsuits with the SEC for violations of the Securities Law. In the upcoming hearing, there will certainly be many developments and clues to change the whole crypto market.

CPI and Fed meeting (June 13 - 15)

The consumer price index (CPI) has long become an important measure to assess the rise and fall of prices and “inflation” in the economy. In the upcoming FOMC meeting, the Fed will rely on macro indicators to make a decision to raise or keep interest rates unchanged, in which CPI is a very important factor. If the CPI is above expectations (4.1%), crypto market asset prices will fall as this factor could prompt the Fed to decide to raise interest rates.

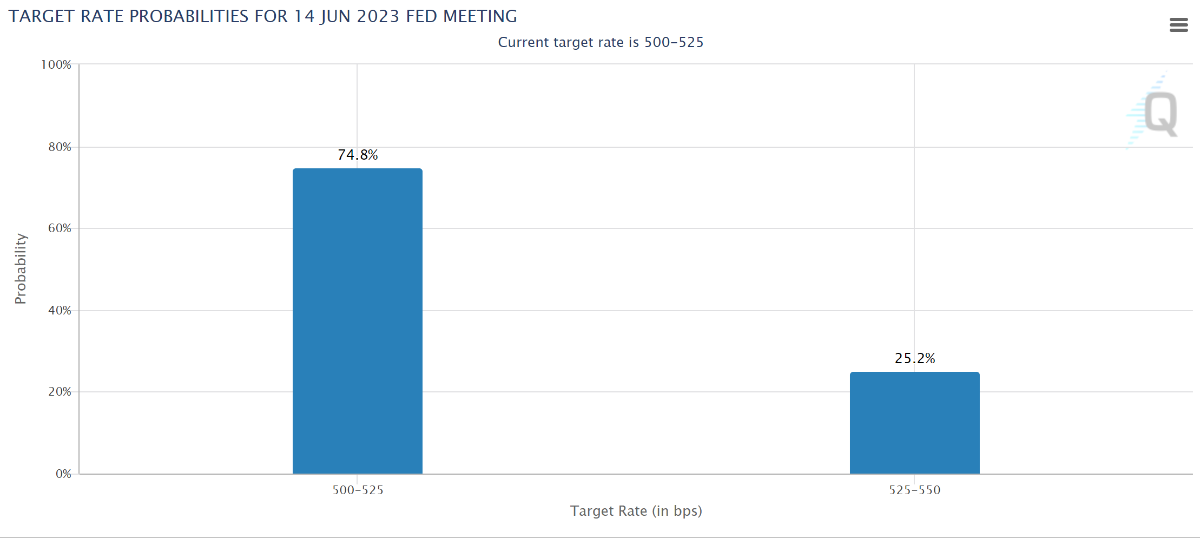

Currently, the crypto market is very much looking forward to the Fed's pause to raise interest rates next Thursday, even the FedWatch Tools gauge is supporting this, when more than 75% are leaning towards this possibility. Whatever the case, volatility in the market is bound to be huge, which could make June 15 a rough night for many crypto investors.

Nearly 75% are leaning towards the possibility that the Fed will stop raising interest rates. Source: FedWatch Tools

According to Lydia Boussour, senior economist at EY, although the decision to "freeze" interest rates is being supported by many people, the FOMC still leaves open the possibility of tightening monetary policy further. Senior Fed officials said they could vote to leave rates unchanged at the June meeting and raise additional rates in July if necessary.

However, there are still opinions that the Fed should continue to maintain its stance when inflation is still raging in the US.

I am not in favor of stopping interest rate increases if it can be proven that inflation is falling and moving towards the 2% target.

Philip Jefferson, Governor of the Fed

However, Don't forget that information in the confrontation between the SEC and the exchanges could break the jubilant atmosphere if the Fed pauses to raise interest rates. Or this could add red color to the market if the interest rate hike scenario happens. We can see that the current market is quite risky and difficult to invest. Therefore, investors need to keep a close eye on developments in the market to make the best decision to put money down.